Future-Proofing the Programmatic Business Model (Part 1)

The third-party cookie is on its way out and the narrative has shifted to alternative advertising capabilities as the digital advertising ecosystem evolves. What does the death of the cookie and other privacy-driven changes mean to the demand players in the industry? There are some immediate and obvious risks, but even greater opportunity to create direct relationships and connections to the supply chain. In this two part series, we explore what DSPs can do to future proof their business.

Third-party cookies are about to be consumed by a FLoC of birds. Kidding aside, these identity changes will have profound implications for DSPs including an immediate disruption to accessing targeted inventory.

Meanwhile, do any of the proposed alternatives to third-party cookies really address consumer privacy in a meaningful way? As we have recently written, privacy concerns are paramount, and in the long run, some of the most frequently discussed solutions are unlikely to meet either increasing regulatory standards or the expectations of the public. For instance, Universal IDs are email based PII identity graphs, using hashed email addresses, and consumers don’t want their emails to be tracked by entities that they have no relationship with. From either a consumer or regulator perspective, it is hard to argue that this approach is a marked improvement from the status quo.

Google’s proposed alternative, Federated Learning of Cohorts (FLoC), is garnering attention, yet is problematic for a number of reasons. Although FLoCs are not PII-based and obscure personal identification, how the technology works is murky. The FLoC approach allows Google to decide how to group consumers into specific cohorts based on their browsing history, and then makes a number of other decisions about cohorts, including how they are shared and how long they last. Because the consumer has no control over which cohort they are in, the results could be discriminatory. Even worse, publishers who might have a relationship with their consumers have no control over these cohorts and no say in how they are grouped or shared.

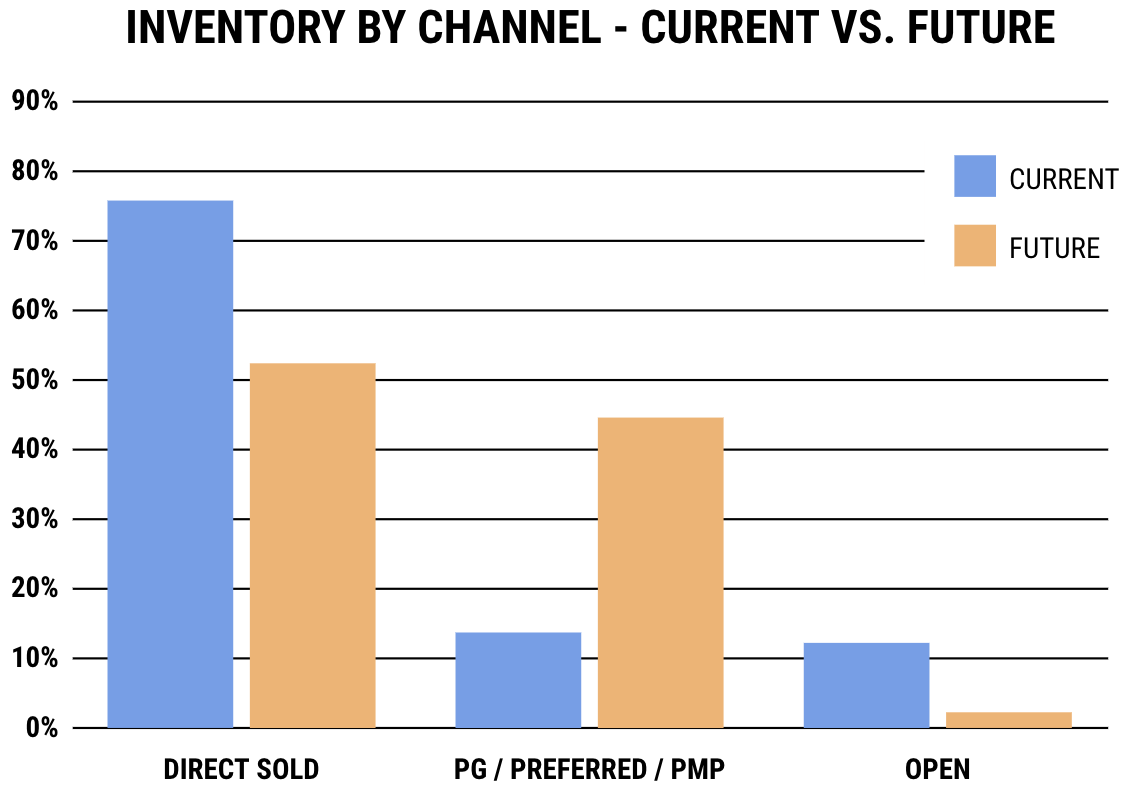

Where does that leave the DSP in terms of inventory? Premium publishers sell more than 80% of their inventory through traditional or programmatic direct channels leaving a limited supply of spot market inventory, and as cross-site tracking fades away, the open market will be under more pressure.

Programmatic direct channels are in an early stage of growth right now, and all signs point to a significant shift of brand dollars moving into the direct space. Extrapolating from our recent survey where 66% of publishers expect growth in programmatic guaranteed and 60% of publishers forecasted growth in preferred deals and private marketplaces (PMPs), we anticipate a shift in inventory by channel that looks something like this:

Given this backdrop, many DSPs will want to diversify their approach to include more forward market inventory as well as alternatives that are not ID or FLoC based. One key strategy for DSPs is to invest in programmatically executed direct deals with premium supply partners. This approach can open up access to the premium inventory which is sold today primarily via direct channels.

Direct deals offer additional benefits to DSPs, including a shortened supply path, more transparency and less chance for fraud. Direct deals also offer tailored media plans and access to a wider variety of media types, creating a more attractive alternative to other channels. More on how DSPs should take action in our next post.